Let's talk about lithium

I wish the Nirvana song was more quotable, sorry everyone

Hi everyone! Links roundup will be following this shortly. This is the promised every-other-week more explainer-y material.

A meta-snag emerges when setting out to write a "minerals explainer" for a project that is, in part, interested in critique of the traditional media narratives and framings around minerals. What's "important to know" about a particular mineral is mostly defined by what that narrative deems important. The dominant narratives of industry tend to be national security, economics, and supply chain management–which is to say, narratives that take capitalism and imperialism as a given.

I tried to avoid being too commodity factsheet about this, but also used it as an opportunity to work on some resources that are a little more in that genre (e.g., starting a small database tracking different mining projects and the companies that bankroll them–is this something readers might want access to? (If so, would it be uncouth to treat that as a paid-subscription bonus? Because it's pretty time-consuming research)). I also realized there's lots of other higher-level stuff that I should do some writing about, like "how do the economics of mining actually work" and "who are all these companies" which I kind of gloss over here. In any case this is new and I'm sort of still feeling out what the tone of this newsletter should be and I hope this is useful!

Lithium, Briefly

A paper from the journal Mineral Economics on the Chilean lithium industry dryly observes in its opening that "Lithium has recently become a 'glamour' metal." In this instance the authors are referring to the demand for lithium from battery manufacturers, but I think there's a case to be made for lithium speaking to the more archaic use of glamour: something enchanting or transformative. The promise of streamlined, elegant post-carbon futurity radiates from the consumer products most commonly associated with lithium batteries (laptops, smart phones, electric vehicles–the stuff that, despite having existed for a long time, still evoke a "futuristic" aesthetic). Not just futurity, even: cosmic futurity, since lithium itself is one of the most ancient of the elements created at the dawn of the universe. An energy future built on star stuff is certainly more seductive than one built on ancient sunlight and desiccated diatoms.

Before a post-carbon future was even a concept I comprehended, I associated lithium with volatility. Not economic so much as psychological.* While the lithium carbonate extracted and sold for the battery industry is almost certainly not identical to the lithium carbonate tablets taken by many people with bipolar disorder, there's something a little on the nose about lithium's history in health applications (including "lithiated lemon-lime soda") being eclipsed now by a so-called "white gold rush" to power presumably a greener shade of capitalism. Lithium is a glamour metal: it transforms people, it enchants capital. (More on this later, probably? Still thinking about it a lot.)

Lithium's ability to reduce volatile emotions contrasts with the volatility it exhibits as a metal. While it's true all batteries are toxic and all energy sources are flammable in some measure, it sometimes amazes me that societies have more or less accepted that to be connected to one another we should all carry what amount to readymade IEDs in our pockets, powered by the same metal that's used to make red fireworks.

But yes, lithium markets are (or at least recently have been) volatile too. Extractive industries work in a weird slipstream. They move astonishingly fast relative to the geologic timescale of mineral formation, but still can end up not quite fast enough for the speed of commodity markets fluctuations, which makes the massive up-front costs for building a mine risky. When trying to make a list of currently active lithium mines around the world (basically to get a little more granular than the standard USGS factsheet list), even publicly available data from May 2019 was seriously out of date. Many of the then-operational mines had suspended production or entered bankruptcy because of overproduction in 2019 sinking the market price of lithium. The pandemic stalling and slowing industrial supply chains worldwide hasn't helped.

Some of the closures are in a way more interesting than the mines that are still in operation. The Nemaska mine in Canada mentioned in the FT article linked above, for instance, was partially financed by SoftBank (the Japanese investment firm better known for backing WeWork and making astonishingly weird slide decks). A mining project in Australia that had signed a three-year supplier agreement with Tesla in 2019 that seemed like a revenue guarantee has been in limbo for most of the year. The only American lithium mine is currently on pause, despite the federal government's insistence that developing mineral supply chains outside of China is a national security imperative.

China doesn't actually mine most of the lithium in the world, although they do mine lithium (the technical name for naturally occurring lithium carbonate, zabuyelite, actually comes from the Lake Zabuye lithium deposit in Tibet). China's main strength is in the production pipeline for processing and manufacturing that lithium into products, i.e. factories. Chinese companies also hold stake in a lot of lithium extraction projects worldwide–Tianqi Lithium, for example, became the world's second-largest producer in the world simply through acquiring stakes in Australia's Greenbushes mine and SQM's mine on the Salar de Atacama.

In the 2011 book Bottled Lightning, journalist Seth Fletcher describes the "big three" mining companies in the lithium business: SQM (Chile), Chemetall (France), and FMC (USA). That 2018 academic paper that labeled lithium a "glamour metal" listed a "big four" composed of SQM, FMC, Albemarle (which had bought Chemetall's lithium holdings, USA), and Tianqi. Since 2018 FMC spun off its lithium operations into a new company called Livent, and today Tianqi is described in media coverage as "embattled." The companies at the top of the lithium market change pretty quickly, but for the most part that change takes the form of corporate spinouts or acquisitions by larger companies. Junior mining firms still pop up and some even persist in the market, but mining timescales favors large-scale corporate inertia to ride out the slipstream. Maybe that's another feature of so-called glamour metals: they cloak a status quo of lumbering, decades-old and too big to fail firms with the illusion of free market opportunity. I tend to roll my eyes at "white gold rush" rhetoric, but it makes sense if placed in the context that events like the California Gold Rush ultimately served to further entrench the already-wealthy rather than creating "self-made" millionaires.

The glamour of futurity is also entangled with the romanticized notion of historical frontier, which shows up in vernacular visualizations of lithium mining. Western media coverage and photojournalism tends to favor South America's lithium operations, and while there are plenty of reasons they merit coverage their sublime aesthetics are, I think, huge selling point. In the vast arid voids of high desert, brine lakes radiate unworldly jewel tones–ceruleans and chartreuses, glimmering gradients you might encounter in an exceptionally self-aware DTC startup's brand identity or an Instagram account posting wellness aphorisms.

(Was that too much? In a world where I have an editor on these I'd probably have to cut that last bit. But I do think it's relevant to consider exactly for whom these particular landscapes suggest "alien" or "future-y" or "surreal" and for whom they evoke, say "a neocolonial extraction project." )

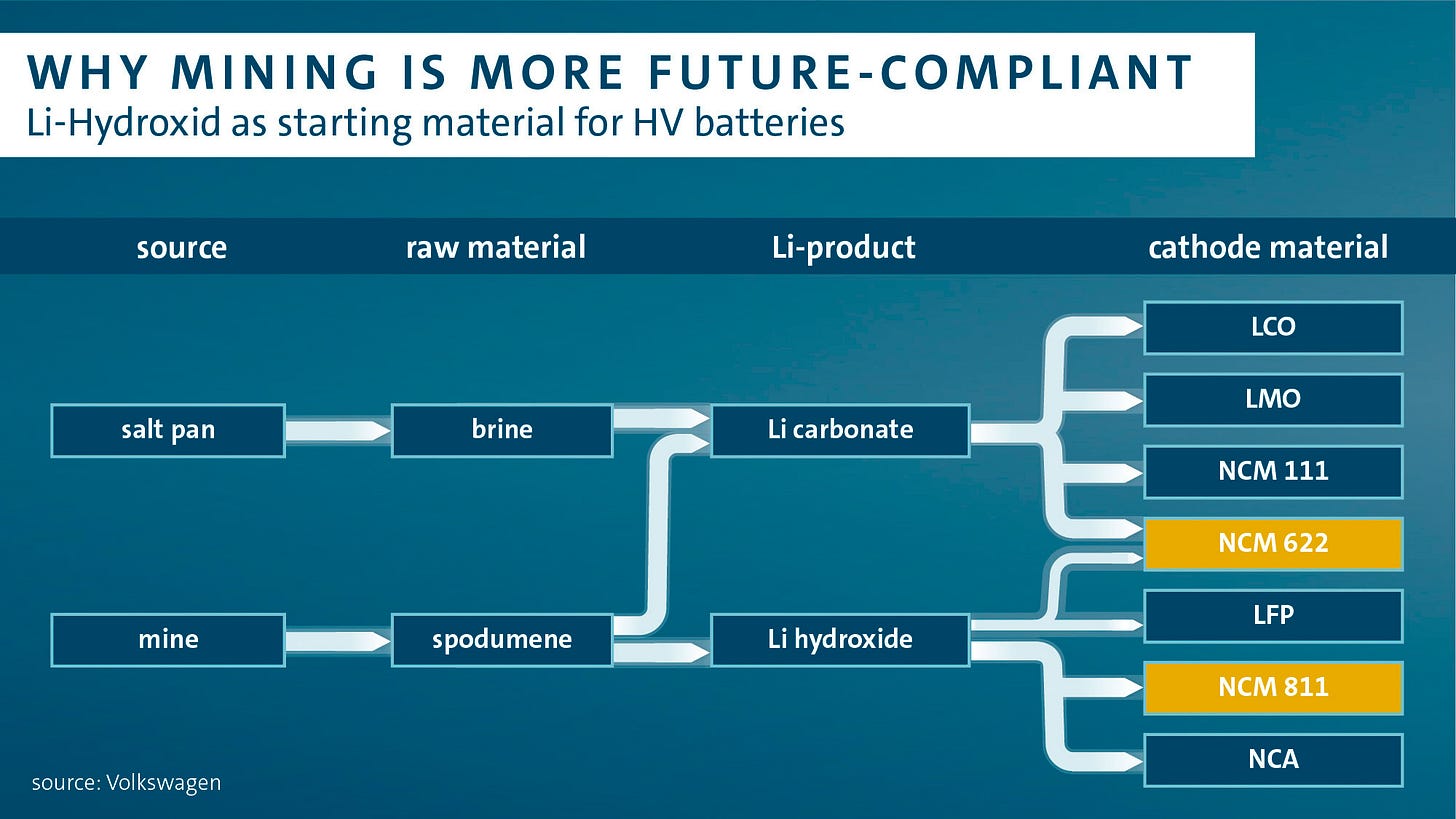

The irony here is that while the Atacama is a significant source of lithium, a huge amount of what's mined today is from hard rock–generally, spodumene-rich pegmatites. (In the crystal and gem market, you'll find spodumene in kunzite and hiddenite if having a symbolic piece of the battery supply chain is your thing.) Some companies seeking to secure their battery supply chains have even argued that hard rock lithium is a superior source because it's easier to turn that ore into lithium hydroxide (increasingly more popular among manufacturers than lithium carbonate I think because it can be used to make batteries with less cobalt?). My favorite demonstration of this is probably this Volkswagen graphic from 2019:

Image description: A graphic, by Volkswagen, with the header “Why Mining Is More Future-Compliant” and the subheader “Li-Hydroxid as starting material for HV batteries.” Below the text, a flow chart shows how different sources and raw materials for obtaining lithium produce different lithium products (lithium carbonate and lithium hydroxide). Lithium hydroxide works better with two cathode materials that Volkswagen sees as priorities.

The phrase "more future compliant" is so fucking resonant and weird, isn't it? It kind of perfectly sums up what's at stake in the transition away from carbon energy and the politics of extraction. "Future compliance" presumes a future that's fixed, planned, obedient. Presumably, it means a future where the power dynamics that ensure smooth supply chains remain so. Lithium is a glamour metal, enchanting the same ecological and political impacts with the appearance of inevitable technological progress.**

*A dumb note I would normally cut in a formally edited version of this: I didn't learn this association from personal experience, but from popular culture–specifically, a shitty 1990s college-campus serial killer movie that I watched as a teen featuring a bipolar, lithium-taking goth character, condemned to death by virtue of being the protagonist's roommate. I'm not proud of this, it's just true.

**Eventually, I promise, I will do a deeper look at "sustainable mining" and what that even fucking means because wow, corporations sure think it's real!